Chegg's $600 Million Question: Can It Outsmart Free AI Tools?

Reviewing Chegg's Busted Convertible Bonds Amidst its Fight for Survival

Follow me on Twitter / Instagram 🚨 Read time below = 19 minutes 👇

This week I’ll be diving into Chegg, courtesy of a current subscriber’s recommendation. While Chegg’s convertible bonds aren’t exactly trading at “distressed” levels, recent price action has certainly caught my attention. Moreover, this situation perfectly encapsulates the existential threat AI poses to certain business models, and whether you’re looking to place a bet or just observe from the sidelines, Chegg’s battle for relevance in the ChatGPT era is definitely worth keeping tabs on.

Quick housekeeping note—I’ll be increasing subscription prices by 14% starting Sunday. If you’ve been on the fence about subscribing, now’s your chance to lock in the current rate before the hike.

Situation Overview:

Chegg Inc. (“Chegg” or “CHGG”) is a direct-to-student online learning platform headquartered in Santa Clara, California. Founded in 2005, the company provides a wide range of educational content and support services to ~7.7 million subscribers globally (2023), with core offerings including Chegg Study, Chegg Writing, Chegg Math, and Busuu, a language learning platform acquired in 2022.

But let’s not beat around the bush—Chegg has long been known as a cheating resource. While the company pays lip service to academic integrity, anyone who’s ever spent time on a college campus knows that Chegg is the go-to resource for students looking to take shortcuts on homework and exams, with many professors viewing the platform as little more than a high-tech answer key. For many years, this value-add service proved essential for college students, creating a highly visible recurring subscription business model that looked to be in the early-innings given a company-reported TAM of 100 million students.

The AI Disruption:

When COVID-19 struck in 2020, Chegg emerged as a dependable provider for students confined indoors due to mobility restrictions. This surge in demand propelled Chegg’s stock to an all-time high of over $100 in early 2021. However, things have rapidly changed since then, and now Chegg finds itself at a critical crossroad as it deals with the disruptive impact of genAI on its core business model. Once a darling of the online education space, Chegg has seen its share price plummet by 55% in 2023, with shares down another 75% YTD in 2024 as the company faces an existential threat from free AI tools like ChatGPT.

The company’s troubles began in earnest when ChatGPT burst onto the scene in late 2022. By March 2023, Chegg was already feeling the heat, with CEO Dan Rosensweig admitting to a “substantial increase” in student interest in the AI chatbot. A Study.com survey hammered home the severity of the situation, revealing that 89% of students have used ChatGPT for homework help and 53% for essay writing.

In response to this AI onslaught, Chegg has been scrambling to adapt. The company launched CheggMate, its own AI-powered study aide, in partnership with OpenAI. However, it’s unclear whether this offering can stem the tide of users flocking to free alternatives. Chegg’s latest earnings call painted a grim picture, with management withholding full-year guidance due to the uncertain landscape.

Financial and Strategic Moves:

Adding to the company’s woes, Chegg’s efforts to juice growth through promotional pricing have fallen flat. Despite offering discounts of 25-35% to new US subscribers, web traffic data from Similarweb showed an 8% y/y decline in 1Q’24. This raises serious questions about Chegg’s ability to attract and retain users in an increasingly AI-dominated education market.

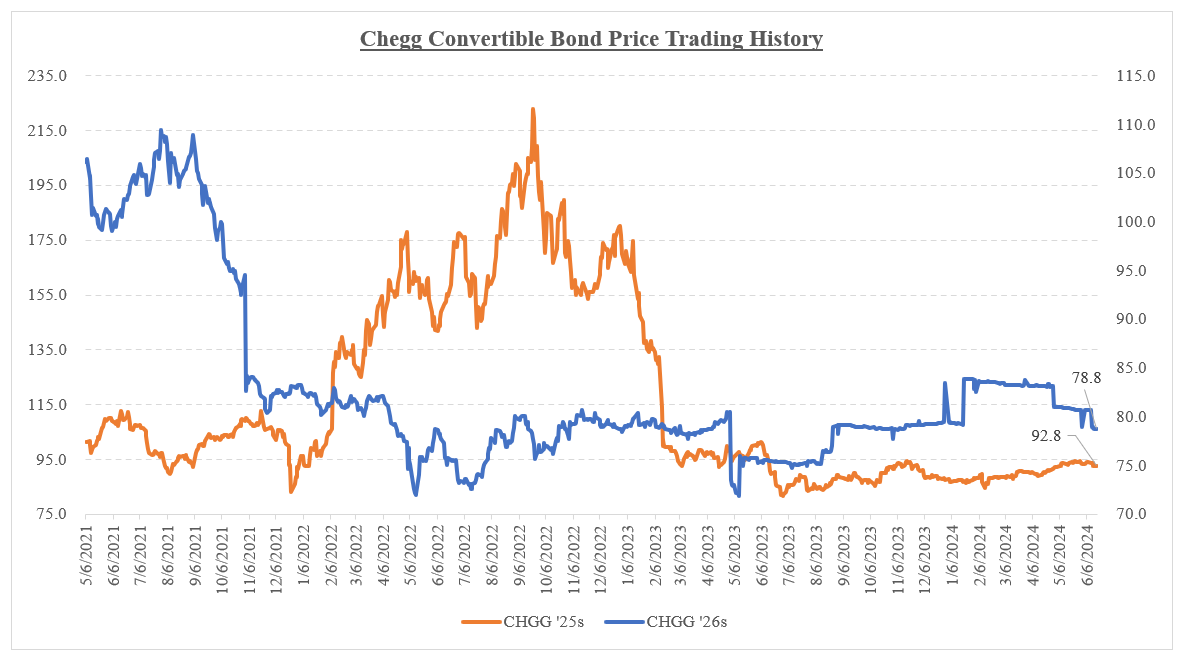

On the financial front, Chegg has been aggressively managing its capital structure. Over the past 12 months, the company has repurchased $427 million of convertible notes at discounts of 11-14% to par, while also buying back 3.4 million shares for $35 million. However, these moves have done little to assuage investor concerns, with Chegg’s 2025 and 2026 convertible notes still trading at double digit yields, well below par.

Restructuring, Leadership Changes, and Outlook:

In a bid to right the ship, Chegg announced a major restructuring plan on June 17, 2024. The company will slash its workforce by 23% (441 employees) and expects to generate annual cost savings of $40-50 million by fiscal 2025. This comes on the heels of a leadership shakeup, with Nathan Schultz set to take over as CEO from Dan Rosensweig on June 1, 2024.

Chegg’s 1Q’24 results did offer a glimmer of hope, with Adj. EBITDA of $46.7 million beating consensus estimates. However, the company’s 2Q guide fell well short of expectations, projecting revenue of $159-161 million and Adj. EBITDA of $38-40 million. Management is pinning its hopes on stronger margins in 2H’24 and a return to growth by 4Q’25, but investors remain skeptical.

With Chegg shares now trading at incredibly low multiples, some value investors might be tempted to take a flyer. However, until the company can demonstrate its ability to compete effectively against free AI tools and return to sustainable growth, it’s likely to remain in the penalty box. The next few quarters will be critical in determining whether Chegg can reinvent itself or becomes another casualty of technological disruption. In the next section, I’ll review the company’s capital structure, financials, and key considerations as well as provide my view on whether the company’s “busted” convertible bonds are actionable at current levels.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.