Buy $NCMI Secured Debt, Not $AMC Equity

The better way to play a recovery in movie theatres

Executive Summary:

If you’re bullish on the return of the big screen, consider investing in the 1L Term Loan B (“1L TL”) of National Cinemedia (“NCMI”) at 79. I think you can generate an 18% IRR / 1.3x MOIC over the next 2 years with relatively minimal downside given ample liquidity ($162mm) and a low create (3.2x 2019A EBITDA). The company has a highly variable cost structure tied to theatre attendance levels which limits FCF burn to $9-9.5mm/month at 0 revenues. At this burn rate, the company has enough liquidity to last another 18 months. Importantly, the 1L TL debt docs are fairly tight, benefiting from two financial covenants (net leverage and minimum liquidity), a rarity in today’s market. Lastly, if the situation does not improve over the next 6 months, I think the 1L TL lenders will be able to extract additional economics from the company upon consummation of the covenant waiver period in July 2021.

If attendance levels and advertising demand return to their pre-COVID levels, there is convexity in this trade with an additional ~20 points of upside. I prefer the 1L TL over the pari passu 1L 5.875% Senior Secured Notes due 2028, given better credit docs, maintenance covenants, and shorter maturity, even though the bonds have a higher coupon and better upside in the form of call protection.

I do not think the equity (NASDAQ:NCMI) is that interesting at $3.57/share (i.e., not a multi-bagger). While the stock could have some decent upside if we return to 2019 levels of profitability and if historical multiples hold, I also don’t have a lot of conviction in either. However, compared to the exhibitors, I think NCMI is better positioned to survive the current crisis given its highly variable cost structure, ample liquidity/limited FCF burn, and debt maturity runway (no maturities until 2025). Importantly, NCMI’s current valuation is still down 30%+ YTD whereas AMC is more-or-less unchanged. AMC also has a much worse liquidity profile. So if you’re extremely bullish and have been buying AMC equity on every dip, consider taking a position in NCMI equity instead.

Company/Structure Overview:

NCMI is the quasi-monopoly in cinema advertising, responsible for the ads played prior to and after a movie screening in over 21,000 screens across 1,700 theatres. To a smaller degree, the company does the poster advertising in the movie theatre lobbies as well as some digital/mobile advertising. The company’s revenues are ultimately tied to advertising demand which is highly cyclical. NCMI’s revenues have been hit hard, both by theatre closures and lower advertiser demand driven by the current recession. Roughly 77% of NCMI’s revenue is national/regional advertising, 15% is local, and 8% is related to beverage advertising on behalf of its founding members. National advertising tends to see a steeper downturn but recovers more quickly than local. The company’s advertising end-market exposure is fairly diversified across industry and advertiser.

NCMI’s cost base is highly variable and largely tied to attendance levels (i.e., effectively a revenue share). The company also pays its founding members a fee for the exclusive access to their theatre circuits. The remaining costs are mainly related to overhead/headcount which have been scaled down temporarily to account for theatre closures (only 53% of its screen footprint is open as of October 2020). In normal times, this business model translated to high margins (~45% EBITDA margins), low capex (~3% of revenues), and significant unlevered FCF generation ($150mm+).

National Cinemedia, Inc. (“HoldCo”) is the publicly-traded holding company of National Cinemedia, LLC (“OpCo”), the operating company described above. HoldCo has no assets other than cash ($63mm) and a 48% economic interest in OpCo. HoldCo also receives a management fee for services provided to OpCo. The remaining part of OpCo is primarily owned by Regal and Cinemark. All of the company’s debt resides at OpCo and is non-recourse to any of its unitholders including HoldCo.

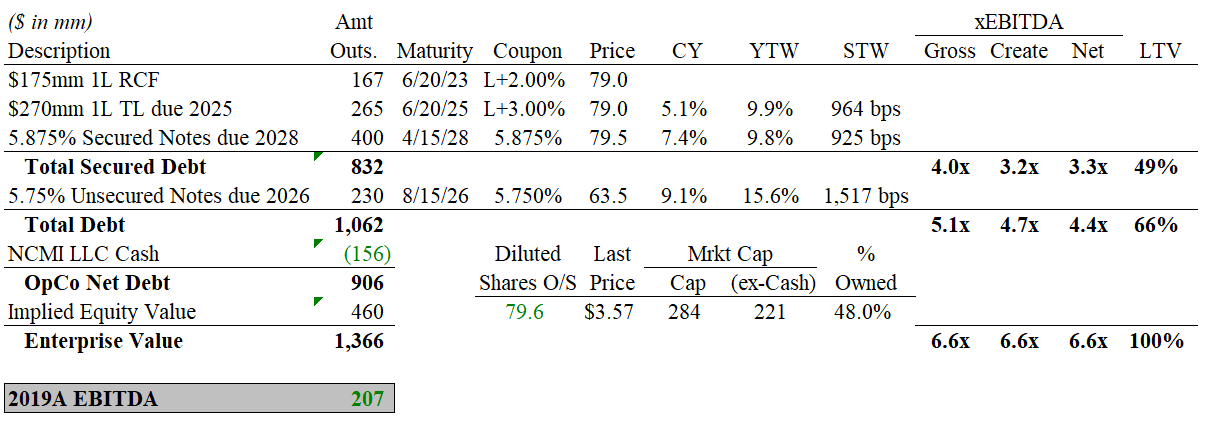

Current Capitalization:

Investment Thesis:

The company is currently burning $11mm/month but mgmt estimates they could lower that to $9-9.5mm in a zero revenue environment. At this rate, OpCo liquidity at $162mm is sufficient for another ~18 months. I will note that the 1L TL has a $55mm minimum liquidity covenant so practically, the company has another ~12 months before they need to re-engage with existing lenders. Mgmt also estimates that they are FCF breakeven (including interest) at 45% of 2019 revenue levels. Separately, HoldCo currently sits on $63mm of cash and the BoD has committed to continue paying dividends. Based on the current quarterly payout of $0.07/share, HoldCo has sufficient liquidity to pay dividends at this rate (~7.8% yield) for another ~3 years. HoldCo cash is non-recourse to OpCo debtholders although I could see this being a point of contention upon future covenant waiver/credit amendment requests.

I prefer the OpCo’s 1L TL as I think they will continue extracting economics from the company due to a tepid but eventual recovery. Where the vast majority of debt deals in today’s market are cov-light, the 1L TL here benefits from 2 financial covenants: (i) net leverage covenant and (ii) $55mm minimum liquidity covenant. The leverage covenant was waived as part of the April 2020 amendment until July 2021. In return, the company is precluded from upstreaming any OpCo cash to HoldCo. I think the company will not be able to de-lever by July 2021 meaning the 1L TL lenders will have another shot of negotiating better terms/economics. The company is also trying to waive the going-concern language required for its 2020 audit. While I’m not privy to current negotiations, I expect some compensation in return for waiving this. Some examples of potential future additional economics include: coupon step-up, amendment fee, lien on HoldCo assets, further upstreaming restrictions, additional covenants, amongst other things. All of these would either be a direct source of increased cash flow or value that would improve recovery for 1L TL lenders. If things normalize sooner than expected and none of this is an issue, you have 15-20 pts of upside given current yield that is well above market.

If you wanted to be aggressive, you could consider building up a blocking position in the 1L TL in order to extract meaningful economics from the company. It’s a fairly small tranche so it shouldn’t be too hard size-wise but liquidity might be challenging. If the company felt it was being held hostage, it could probably refi the existing 1L TL with new, higher-coupon secured paper but in this case, you’d be taken out ~20pts higher at par.

The credit docs currently permit $50mm of secured debt capacity under the general debt/liens baskets. What’s interesting to note is that this limitation is bound by the 5.75% Senior Unsecured Notes due 2026 which if taken out, would increase secured debt capacity to $225mm. This is interestingly around the same size as the unsecured debt tranche ($230mm). What this means is that the company could technically do a concurrent refi of the existing secured credit facilities (where the MFN makes it cost prohibitive) AND unsecured notes, rolling all of the unsecured debt into new secured paper. For this reason, I prefer the 1L TL over the 1L Senior Secured Notes as the shorter maturity and covenants mitigate this risk.

To summarize, I think the secured paper (1L TL specifically) provides a compelling risk-adjusted return.

Upside: For obvious reasons, OpCo’s secured debt (~1,000bps) currently trades well wide of performing secured paper. I think the debt can tighten to a 400-500bps context once we start seeing a recovery but it very much remains a “show me” story. While the 1L TL is capped at 100, the secured bonds have call protection which should allow them to trade well above par. For example, at 400bps, the implied bond price in 2 years time equates to ~106. For additional context, these same bonds traded inside 300bps pre-COVID (equivalent to a 112 dollar price in two years time). You definitely have more upside in the secured bonds but for reasons mentioned earlier, there is less risk investing in the 1L TL, whose lenders should be in the driver’s seat of all future creditor negotiations.

Downside: At 79, you are creating the business at 3.2x 2019A EBITDA. The business traded in the 8x EV/EBITDA context historically. Using this logic, EBITDA needs to recover to ~$80mm for the 1L TL to be unimpaired. Even though I think recovery will be slow, I don’t think it takes a lot for the business to get back to this level. And with the recent vaccine announcement, you now have a line-of-sight towards an eventual recovery. As outlined above, I think there is less risk for collateral dilution for the 1L TL vs. the 1L Senior Secured Notes.

While HoldCo equity could work here, it requires a lot of high conviction assumptions (i.e., return to historical profitability and multiples). Given the amount of leverage however, there’s a lot of optionality in the equity so I do not recommend shorting it by any means. If you’re pretty bullish, I’d consider the unsecured notes which have similar upside but better downside. I don’t have a high conviction view on attendance levels or how soon that recovers, if at all, which is why I prefer the secured vs. unsecured debt tranches, where you have possibility of real capital impairment. Below is a summary of my return expectations across the various parts in the capital structure. Note that this does not assume any incremental economics provided to 1L TL lenders, which I think are very likely.

Historical Financial Performance:

The business is fairly simple and historical financials need little explanation. As you can see from the charts below, NCMI ran a fairly stable business pre-COVID that generated significant unlevered cash flows. To the detriment of debtholders, almost all of this was distributed to unitholders. As per the recent credit amendment, all of this cash is now blocked from being upstreamed to unitholders.

Financial performance over the last two quarters is largely irrelevant as the majority of the company’s theatre circuit has been closed. As you would expect, revenues are down ~95% y/y in both quarters. Surprisingly, NCMI generated about $47mm of CF in 2Q due to an A/R drawdown. This subsequently reversed and the company burned about $43mm ($14mm /month) in Q3.

Valuation:

There aren’t any good comps for this business. Historically, NCMI has traded in the ~8x EBITDA and ~9% dividend yield context. On one hand, you could argue multiples should be lower given permanent changes to the entire industry (e.g., shrinking movie window, etc.). On the other hand, one could also argue for higher valuations given lower interest rates and increased demand for “yield” by investors.

What do you think happens to the ESA with AMC if AMC files?

Also how do you perceive the risk of production companies moving film launches to online OTT platforms such as Netflix, Disney + etc. Is there any way of moving the advertising online to these channels ?