A Sober Assessment of $EXPR

The bull case for a "dying" mall-based retailer

The recent stock price run-up of specialty mall-retailer, Express (EXPR), did not go unnoticed. The stock has long been on my radar but after the 500%+ runup over the last month (actually over the last 9 days), I decided to take a closer look—perhaps there was something here beyond the WSB-induced mania. In case you haven’t been following, see the stock price trading history below:

Much like for GameStop, media pundits and “professional” investors have attributed ALL of the recent runup to “speculation” that led to a price that is completely disconnected from “fundamentals.” That may very well be the case; however, the counterargument is that the equity was deeply undervalued and warranted a second look to begin with.

For those that are unfamiliar, Express is a specialty mall-based retailer. The bear case is easy to paint: Express is a dying, B&M retailer with a worthless brand whose fashion is out-of-date. The company has massive lease obligations, is hemorrhaging cash, and just took on very expensive debt (L + 800) from a “loan-to-own” type PE shop (Sycamore). On top of this, you have COVID resulting in lockdowns and perhaps permanently changing the need for occasion-based clothing (e.g., semi-formal work attire). Competition is high, switching costs are none, and B&M retail is further being disintermediated away by new ecommerce players who aren’t burdened by legacy fixed costs.

This is all pretty-much known and I would argue, was largely reflected in the stock price (pre-runup). At its absolute low, the stock’s market cap was ~$40mm. At a sub-$100mm market cap (compared to its ~$2bn peak), the market was basically pricing in bankruptcy. Even Hertz, who is IN BANKRUPTCY, has a higher market cap. Keep in mind, today’s market cap was basically where the equity was trading at pre-COVID, which was arguably undervalued to begin with.

Despite the runup, many investors still completely dismiss the idea that Express can have any value and that its price is 100% disconnected from fundamentals. Take a look at the two most recent SeekingAlpha for example.

Some even go as far as attributing the “speculation” entirely to one Tweet, calling it a blatant “pump and dump.”

In public markets, the range of possible outcomes if ALWAYS wider than you expect. What if this tweet just highlighted that EXPR was completely undervalued to begin with? Despite its challenges and risks, it is not inconceivable to me to imagine a scenario whereby EXPR is >$10/share. Below I examine the “bull” case scenario for Express. This is not by any means my base case but I did want to provide some perspective on an upside scenario where the stock is easily worth multiples of its current price today.

Valuation is Undemanding:

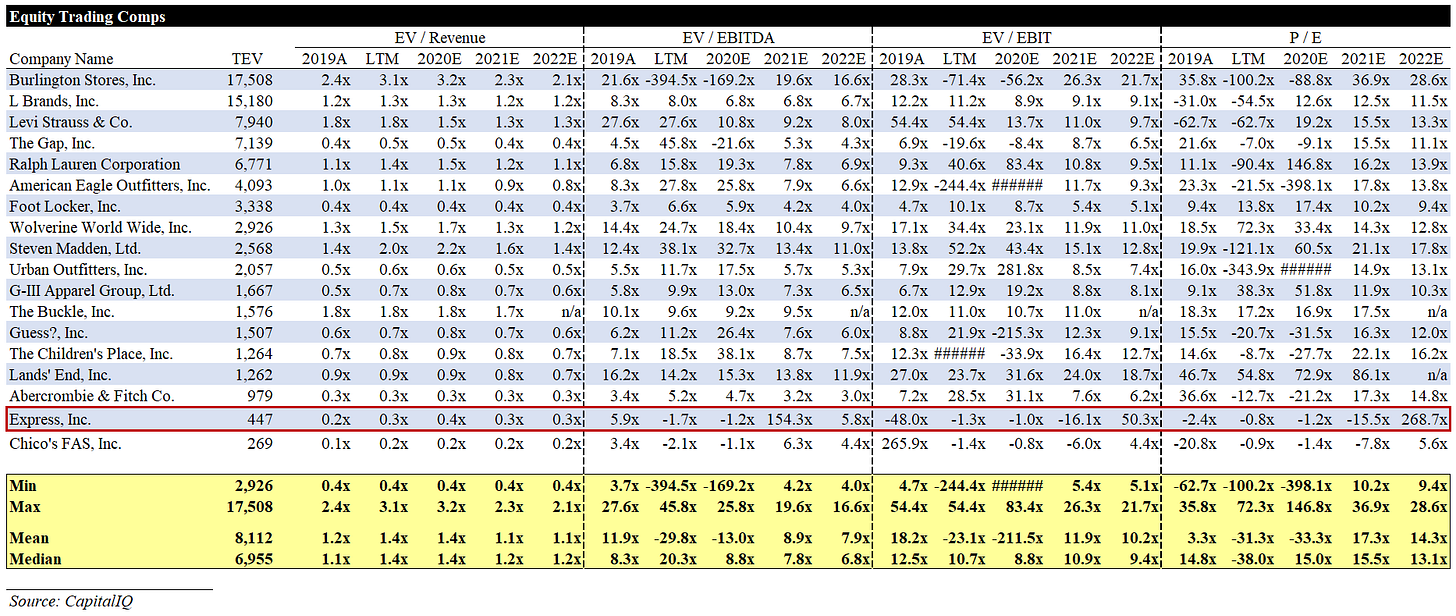

Express did ~$2bn of sales pre-COVID. On an EV/revenue basis, the stock is one of the cheapest B&M retailers. The company has massive fixed lease expenses and margins are lower so obviously not a great metric to compare but to the extent they can optimize their cost structure, that’s actually a lot of sales for a company <$500mm in value.

Should we return to 2018/2019 levels of profitability, today’s value is actually very undemanding at 3-5x EBITDA or 5-9x FCF.

Recognizable Brand:

Express is a highly recognizable brand that has been around for over 40 years. In today’s fragmented universe of brands, name recognition provides for optionality, even if that brand is currently not so strong. And while turning a brand around is no easy task, there is precedent to it. Take a look at Kanye West’s impact on Adidas and its stock price. I’m not saying Express is a valuable brand today but all it could take is a similar partnership with another mega celebrity / influencer to make the brand relevant and in vogue again. The company has over 1mm followers on IG, which is not a lot in absolute terms but is comparable to competitors like Banana Republic (part of Gap).

Huge Tailwind Post-COVID

Express’ “bread and butter” as a brand has always been in occasion dressing, which of course, saw declines when proms, graduations, weddings and so many other occasions simply did not happen last year. As we emerge from the pandemic, and there is a surge of occasions and celebrations, pent-up demand, coupled with there being fewer places for customers to make these purchases, could turn a 2020 headwind into a 2021 tailwind.

I assume most of us have put on a few pounds over the last year. Old wardrobes no longer fit and even if they do, you probably want to refresh it anyway. People have already bought up enough leisurewear clothing over the pandemic and probably won’t wear that to the office (if you actually care about appearances or perceptions). Couple this with a potential boost from consumers armed with stimulus checks and your headwind now becomes a tailwind. Any semblance of normalcy might drive occasion-based apparel purchases and we might even see a v-shaped recovery in revenues over the next year. Keep in mind that 2Q comps will be incredibly easy this year—we may see some 50%+ y/y growth quarters.

I do not believe that occasions that drive people to wear suits, dress shirts and dresses are gone for good. Those occasions will clearly still exist, and Express will be positioned to grab market share from some of its competitors, including department stores who've typically been very dominant in those categories.

Growth in Digital / Success in New Fashion Trends / Brands (UpWest)

The company has a growing online sales channel. While they don’t break out the % in their financials, it is a growth area for the business. Further, they can use their existing stores as distribution points, improving productivity. I believe omnichannel is the future and Express at least does have a gameplan here.

The company is also seeing success in UpWest, a digital-native brand that was developed a year ago. While the size is not significant today, it is exceeding management’s expectations and helps them inform their decisions on digital for the Express brand. In addition, the company is introducing new products to its brand, which are gaining positive traction with consumers. The CEO formerly worked at 7 Jeans and it’s quite evident in the company’s new product mix (e.g., Luxe Comfort Denim).

Balance Sheet Is Solid, Providing for Optionality:

Pro forma for its recent Sycamore financing, liquidity is more than sufficient at approximately $337mm, comprising $193mm of cash and $144mm of revolver availability. In addition, the company has a $112mm income tax receivable of which approximately $95 million is expected to be received in Q2 of this year. This is real cash that will be used to repay debt. In terms of debt maturities, there are none prior to 2024. Pro forma for the tax receivable (highly likelihood of payment given its from the US govt), I get to ~$500mm of pro forma liquidity.

Cash burn is about $50-60mm a quarter. The company’s current liquidity will buy them ~2-2.5 years at this rate. This should only improve as lockdowns ease with an improvement in weather/increased vaccinations. The company could also issue equity after its more recent stock price runup which would also improve liquidity and further de-risk the situation. In my opinion, by no means is the company at risk of filing anytime soon.

Opportunity to Rationalize Store Footprint

The company has nearly 600 stores (592 to be exact) as of October 200, all of which are leased. As a result, the fixed lease expense per year is fairly sizeable at $200-250mm. Before COVID even happened, the company was planning on closing 100 unprofitable stores— that plan has only been accelerated. The company should be able to exit unprofitable locations at a reduced cost and/or receive rent abatements (already secured $25mm YTD). Mgmt is also testing smaller footprints in mall-based stores including pop-up stores, which could improve relative productivity.

What this might mean is a smaller but more profitable and productive store footprint. Mgmt is targeting a LT mid-single digit operating margin (EBIT). So while one might look at lease obligation, add it back to EV, and conclude that there is too much financial risk, it’s important to note that operating leases are NOT debt. Debt has a hard maturity with a balloon payment, leases do not. Lease can also be terminated or renewed (potentially at lower rates) at the end of the lease. The average lease for Express is 5.7 years, which in theory means they can renew/cancel ~17% of their leases ever year.

The merits outlined above combined with some positive catalysts could serve for significant price appreciation. Pair that with a relatively high short interest (12% of public float), a highly motivated WSB/Reddit movement (EXPR is one of the stocks whose trading action has been halted by Robinhood), and you have a recipe for a super charged stock with potential for explosive price action. Here’s a few catalysts that could cause the stock to rip even higher:

Increased Sell-Side Coverage / Initiation

Here are the banks that currently cover EXPR. As you can tell, there are no major banks that cover the name. Coupled with fervent interest from WSB, we are one “buy” initiation away from this having a snowballing effect on the company’s stock price. An increased market cap should allow for increased institutional buying which should have a net positive effect on the stock price (i.e., institutional investors are not buying $50mm market cap specialty retailers but a $1bn+ market cap coupled with a positive narrative and reputable sell-side coverage is a lot more digestible).

Media Hype Results in New Customers

All the recent media hype is actually free marketing for the Company. I can’t recall the last time I thought about Express prior to last week’s events. If the stock price continues to surge, all the media attention might actually translate to increased website traffic and therefore sales. Remember, publicity is always a good thing (well not always but you get the point).

Partnership announcement with celebrity / influencer

This one needs little explaining. All it would take is some announcement with some major celebrity like this. Check out Gap’s stock price performance since then:

Acquisition by a Strategic / Sponsor

Express is a recognizable brand which could make sense to a strategic at the right valuation, especially if it can be all debt financed (financing for corporates is basically free money in today’s credit markets)

Potential Returns:

In summary, next time someone from the media or a “professional” investor complains about the rampant speculation by retail investors, ask them to consider the upside scenario for a given stock. I highly doubt any of them have actually looked at the financials or considered the upside scenario. Instead, they continue to parrot the same arguments ad hominem. As I mentioned earlier, the range of outcomes in public market investing is always wider than one expects. However unlikely it is, there is always a bull-case to be made.

Lastly, if you don’t believe in any of the above or take my word for it, at least have a quick read of mgmt’s “investment thesis” as outlined in their last earnings presentation:

https://www.morningstar.com/news/marketwatch/2024042279/express-files-for-bankruptcy-will-close-95-express-and-all-upwest-stores

https://www.morningstar.com/news/marketwatch/20240424970/a-new-wave-of-e-commerce-disruption-could-close-45000-retail-stores-over-the-next-five-years-analysts-say

It appears, with hindsight (who doesn't love follow-up reading investment theses?), Express could of hired George Clooney (like he'd put his name on yet another boring B&M circling the drain, not that they could afford him) and it would not have been enough to put Humpty-Dumpty back together again.

On the bright-side of life, EXPRQ went up 200% on October 14, 2024. It surged from 0.02 to 0.03 cents. Morningstar's quant garbage rating puts EXPRQ at a "fair value" of 0.07 cents.

Hope you applied the In-and-Out Burger philosophy if you followed you own conclusion. If so, then you maybe made a tasty hamburger meal out the "bull-case."